- The Chairman’s training

- Board strategy review facilitation

- Board reviews

- Succession planning

- Board risk strategy and management

- Basic directors training – role and duties, finance essentials and strategic directors issues

- Business valuations for owners and advisors

- Strategic Financial skills for directors and senior management

- For Business Owners, CEOs, Directors, Senior Executives and other business professionals

Board risk strategy and management

We mention these risk with the help of business coaching services below to complete the coverage that you might need at board levels, but note that these risk services are provided by third parties (as below) and not provided by International Business Mentors.

Would your board, independent and non-executive directors, risk audit committees like to have:

- A Business Risk Audit:

- An independent assessment of the overall risks, which are impacting the business?

- Suggestions on how to improve risk strategy and management?

- Visible tracking of the business risk over time?

Board Risk Philosophies

Effective Risk Management is central to maintaining and improving competitive advantage, and “Change is the law of life.

“Those who look only to the past or the present are certain to miss the future.” John F. Kennedy.

Understanding risks in today’s rapidly changing global competitive market place is fundamental.

We take a holistic approach to risk management and show intangibles measurable and establish key performance indicators (KPI’s) for risks to be managed.

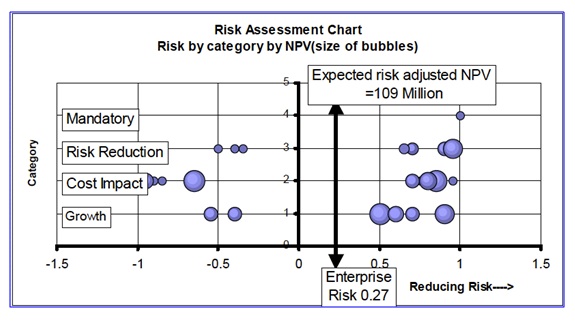

Managing and sharing knowledge about known risks is the key start point in assessing risk and the potential impact on the business Category

We focus our efforts on identifying, assessing and the how to control risks.

We help you develop a risk strategy based on principles of risk management, with the aim in achieving effective ‘transparency’ in risk management for the board.

This transparency will help alignment of your strategy; processes, competency, technology and knowledge and the consequent change in behaviour in your organisation, which helps to ensure that you can embed the principles of risk management into all risk producing areas of the business:

Strategic business risk areas:

- Customer

- Competitor

- Operations, Suppliers

- Finance

- People

- All Systems and processes

- Other stakeholders

To ensure your people can effectively forestalling the legal liabilities and damage to the business transparency is critical to establish clearly defined level of competence at which risk management decision are made for every level in our organisations.

Risk competent people then establish the acceptable levels of risk in each area

- As Low As Reasonably Practical (ALARP)

- Level of risks, which is recorded and communicated ensuring all people have a clear understanding of the ALARP to be maintained.

For the As Low As Reasonably Practical (ALARP) levels of risk to be implement we design and implement a new system of measurement. This new system of measurement ensures the alignment of your strategy; processes, competency, infrastructure and technology (including hardware or software or people-ware), and knowledge meets customer demands at our agreed level of risk, which we can insure with confidence.

Continuous risk review will lead to changes in your risk index and improve the risk management of the business.

Transparency

Definition:

Transparency is the process to establish the relationships of risks within ‘systems’ making visible how all components work together for the life cycle and facilitates the standardisation of processes in managing overall risk.

To achieve transparency required the developed of specific approaches which suit your particular business.

Lack of Transparency

It is the lack of transparency in the life cycle phases of specification, projects, operation, maintenance, and dismantling where the uncertainties of the future remain hidden and elusive until it is too late for people (Operators, Maintenance, and Contractors) to forestall the law of unintended consequences and for which the Board, and the Executive have to provide answers and pay for the consequences.

Transparency also affects the behaviour of people in managing their allocated level of risk throughout the organisation, which consequently affects the bottom line performance and Shareholder value.

Transparency is the cornerstone in establishing risk performance needs, levels, targets and building new knowledge in mitigating risks, and aids in achieving informed decision-making with higher levels of competence in managing risks.

- Address the behaviour and culture of people

- Bring about a phase shift in the power of knowledge to facilitate change in the behaviour of people

- Establish internal/external strategic partnerships of knowledge sharing

- Capture/maintain and track status of whole of life cycle learning of all people involved in decision making for the life cycle of the technology in use.

- Ensure current management systems provide verified and validated data/information to enable the Board/Executive & people to make informed decisions

- Share knowledge of currently perceived risks, define risk and build new knowledge

- Establish transparency – a process of establish the relationships of risks within ‘systems’ making visible how all components work together for the life cycle

- Rank and record analysed risks at the ALARP and match risks to organizational hierarchy of competence for informed decision making

- Plan the control system to continually verify and validate risk performance needs, levels, targets and measurement processes.

- Communicate deviations from agree ALARP level of risk.

- Corrective Action & Authority/Competence

- Secure the internal and new intellectual property for the life cycle of the business.

For further discussion please contact us:

Risk Chairman, David Cartney

davidcartney@bigpond.com